April, 2025 by WIETEC

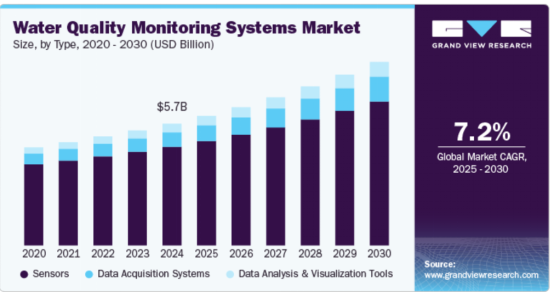

The global water quality monitoring systems market is poised for transformative growth as climate change, industrial pollution, and stringent environmental regulations amplify the need for real-time water management solutions. Valued at $5.8 billion in 2024, the market is projected to expand at a CAGR of 12.3% from 2025 to 2030, reaching $12.1 billion by 2030. This report analyzes market dynamics by type including sensors, data acquisition systems, data analysis tools, application for industrial and commercial, and regional, offering actionable insights for stakeholders.

Market Overview

Water quality monitoring systems are critical for detecting contaminants like heavy metals, pathogens, and microplastics in water bodies. Demand is surging across sectors include industrial compliance with EPA, EU Water Framework Directive, and China’s Water Ten Plan; Commercial requirements by hotels, hospitals, and municipalities ensuring safe drinking water, and emerging tech such as IoT, AI, and satellite integration are redefining monitoring precision and scalability.

Market Segmentation

Sensors takes up the largest segment, with 45% share in 2024. Products are mostly dominated by pH, dissolved oxygen DO, and turbidity sensors. Growth expected at 13.1% and major growth drivers are miniaturized, low-cost IoT sensors

Data Acquisition Systems is the fastest-growing sector, with an expected growth of 15.2% CAGR. Products and solutions include wireless systems such as Hach's Hydromet enable remote monitoring. This sector is demand driven by smart city projects in Asia and the Middle East.

Data Analysis & Visualization Tools, AI platforms like IBM's Watson Water predict contamination events and integration with GIS for watershed management.

By Application

Industrial market share takes up to 55% of market share in 2024. Key sectors include oil & gas, chemicals, power generation and mining. Commercial accounts for 45% of market share and key sectors include municipalities with smart water grids in cities like Singapore and Amsterdam and healthcare sector.

By Region

Asia-Pacific accounts for 35% of total segment share with growth rate of 14% CAGR. Countries like China & India is facing rapid industrialization and pollution crises. As example, China's Sponge City initiative mandates IoT-based stormwater monitoring.

North America is expected to grow at 11.5% CAGR accounting for 30% of total market share. Catalyst for growth includes U.S. Lead EPA's Clean Water Act revisions 2024 require IoT compliance for industries and Canada’s focus on Arctic water quality amid permafrost thaws.

Europe accounts for 25% of the market share and is expected to grow at 10% CAGR. EU Green Deal mandates real-time nitrate monitoring in agricultural runoff and Germany is a hub for sensor R&D.

Rest of the World accounts for a total of 10% market share. In the Middle East, desalination plants adopt AI-powered brine monitoring and solar-powered systems for off-grid communities are widely used in Africa.

Growth Drivers includes regulatory pressure of stricter EPA and EU directives on wastewater discharge; Smart Water Infrastructure with $150 billion global investment in IoT-enabled systems by 2030; climate change, droughts and floods necessitate adaptive monitoring and, health awareness post-pandemic focus on pathogen detection. Challenges are high costs as advanced systems remain unaffordable for developing regions; data security risks and shortage of technicians for AI and satellite data interpretation.

Future Trends to watch of for are AI-powered predictive analytics; nano-sensors graphene-based detectors for trace pharmaceutical residues; blockchain for data integrity and, satellite monitoring.

Three Key Takeaways

Sensor Dominance: IoT and miniaturized sensors will drive 45%+ market growth by 2030.

Asia-Pacific Leads: China and India's pollution and smart city projects fuel 14% CAGR.

Sustainability Convergence: AI and renewable-powered systems are critical for ESG compliance.

Disclaimer

This analysis leverages data from industry reports by Grand View Research, Mordor Intelligence and corporate filings as of Q2 2024. Market conditions may shift due to regulatory changes, technological disruptions, or geopolitical factors. Readers should consult primary sources for strategic decisions.